Australian stocks and the Australian dollar declined as the market started to worry about trade. Some market participants believe that a trade deal between the US and China is still a long way to go. Others doubt whether anything will change even when a deal is sealed. The market also reacted to Chinese trade numbers. The latest data showed that Chinese exports declined by -0.9%. This was better than the expected decline of -3.5%. It was also better than the previous decline of -3.2%. Imports declined by -6.4%, which was lower than the consensus estimates of -8.9%. As a result, the trade surplus increased to $42.81 billion from the previous $39.65 billion.

The AUS200 index declined to an intraday low of $6710. This price was below the 61.8% Fibonacci Retracement level. The price is below the 14-day and 28-day EMA. The two averages are making a bearish crossover. The RSI has declined from a high of 78 to the current 40. The pair may continue moving lower to test the 50% Fibonacci level of $6700.

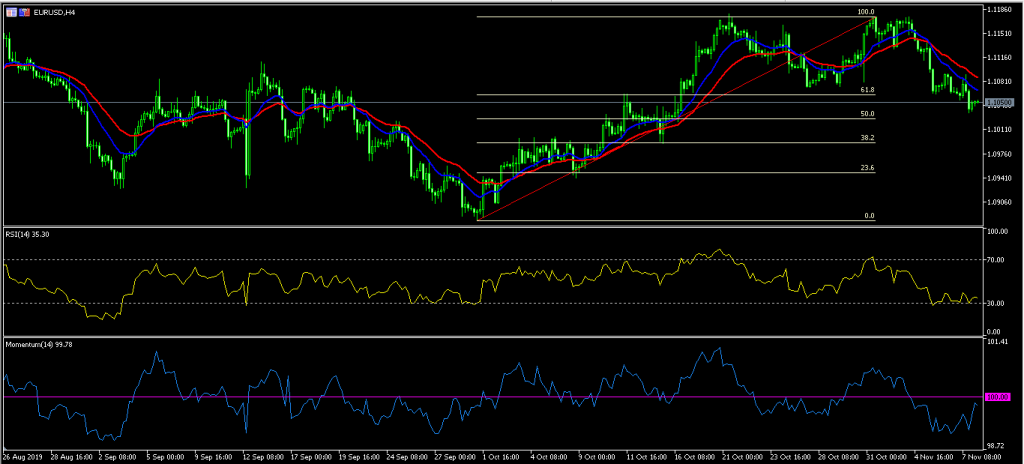

The euro has been on a downward trend this week as traders reflect on the health of the region’s economy. These fears became real yesterday when the European Commission lowered the growth forecast for the region. The commission blamed the ongoing trade wars between China and the US and between Japan and South Korea. It also blamed the ongoing uncertainty about Brexit. The commission expects GDP of the 19 member states to grow by 1.1% in 2019. This was lower than July’s forecast of 1.2%. The region will grow by 1.2% in 2020 and 2021.

The EUR/USD pair has declined sharply this week. The pair has dropped from a high of 1.1175 to a low of 1.1035. On the four-hour chart, the pair is trading between the 61.8% and 50% Fibonacci Retracement levels. This price is below the 14-day EMA and 28-day EMA. The RSI is slightly above the oversold level of 30. The momentum indicator has risen to almost 100. The pair may continue to decline today as the market receives trade data from Germany.

The Canadian dollar declined slightly against the USD ahead of the release of Canadian jobs numbers. The market expects the unemployment rate to remain unchanged at 5.5% in October. They expect the participation rate to have remained unchanged at 65.7%. The employment change is expected to come in at 15.9k. This is after rising by 53.k in September. The market will also receive the housing starts and building permits data. Housing starts are expected to remain unchanged at 221.2k while building permits are expected to have declined by -2.0%.

The USD/CAD pair moved slightly higher during the Asian session. On the four-hour chart, the pair is trading at 1.3185, which is slightly above this week’s low of 1.3115. The price is along the 50% Fibonacci Retracement level. The price is also above the 14-day and 28-day moving averages. The signal line of the MACD has flattened above the neutral level. The pair may see some volatility ahead of Canadian payrolls data.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 22325