The Australian dollar rose sharply after the RBA delivered its interest rates decision. The bank left interest rates unchanged at 0.75%. This was in line with what the market was expecting. In the accompanying statement, governor Lowe predicted that a combination of factors would propel the Australian economy higher. These are lower taxes, improving materials sector, recovering housing market, and low interest rates. At the same time, he said that the central bank officials said that there was a possibility that rates would remain low for an extended period of time. He also said that the board was prepared to ease further if need be. While the Australian dollar rose, Australian stocks declined as a new wave of trade wars started.

The AUS200 index started declining yesterday, when the index reached a high of $6900. The index formed a triple top pattern around this level, which is a signal of a new downward trend. This was confirmed yesterday when the short and longer-term moving averages made a bearish crossover. The RSI also has been moving lower. The index may continue to move lower as the market reacts to new data.

The S&P500 index declined sharply yesterday. The decline was mostly a reaction to the new trade war between the United States and Argentina, Brazil, and France. Donald Trump said that the US would add new steel and aluminium tariffs from the two South American countries. The administration also announced that it would add a 100% tariff on French goods. Meanwhile, the market will start receiving earnings from key companies. The companies that will report today are Salesforce, ZScaler, Workday, and Marvell Technology Group. The companies that will report tomorrow will be Elastic, Five Below, Synopsis, and Slack.

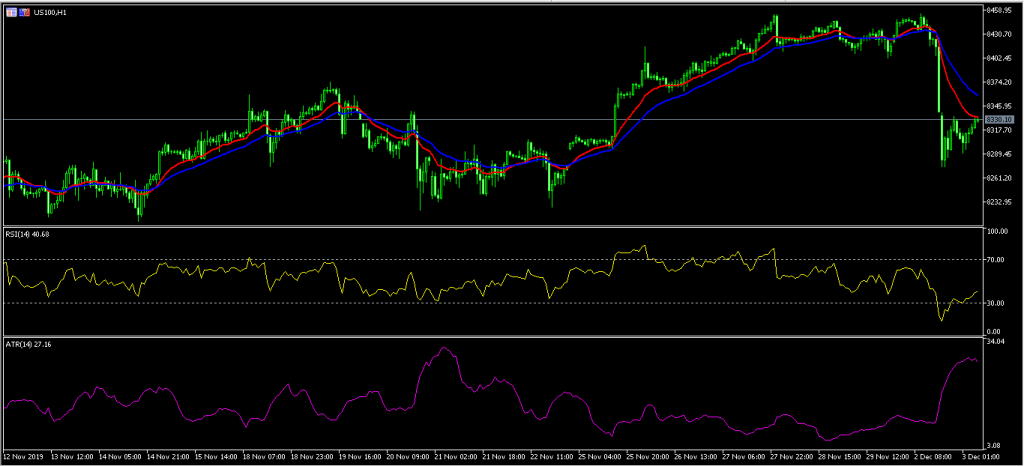

The S&P500 index declined from a high of $8453 to a low of $8274. The index had formed a double top, which is usually a bearish signal. The price is along the 14-day moving average and below the 28-day moving averages. The RSI, which reached a low of 14 to the current 40. Volatility has continued to increase as evidenced by the Average True Range (ATR). The index may continue being relatively volatile as the market reacts to the new trade wars.

The Swiss franc rose against the USD as fresh unforeseen market risks started to emerge. This happened after Donald Trump announced fresh tariffs on goods from Argentina, Brazil, and France. Another reason is that data from the US was relatively tepid. The ISM manufacturing PMI dropped to 48.1 from the previous 48.3. This was the third straight month of contraction. This happened as PMI data from other countries, particularly China, showed signs of improvement. The market will receive CPI data from Switzerland, where the headline CPI is expected to continue being subdued.

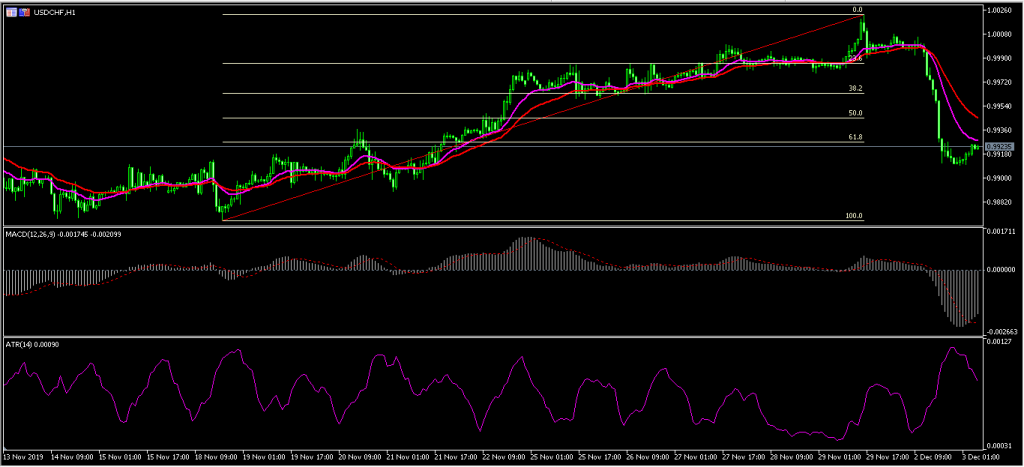

The USD/CHF pair declined from a high of 1.0022 to an intraday low of 0.9908. The price dropped below the 61.8% Fibonacci Retracement level. The signal line of the MACD has moved significantly lower while the average true range has started moving higher. The pair may see some volatility ahead of the US employment data that will be released tomorrow and on Friday.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 22355