Global stocks rose after the Federal Reserve slashed interest rates yesterday. In the United States, the Dow and S&P 500 rose by 115 and 10 points respectively. In Asia, Chinese and Japanese stocks rose as well. The China A50 Index and Nikkei rose by 30 points and 40 points respectively. These gains were in reaction to the Fed decision to slash rates by 25 basis points. In the monetary policy statement, the Fed said that it was pausing on further rate cuts. The members pointed to positive developments on trade and Brexit. This decision came a few hours after the US released the first reading of third-quarter GDP data. In the third quarter, the US economy rose by 1.9% after rising by more than 2% in the previous quarter.

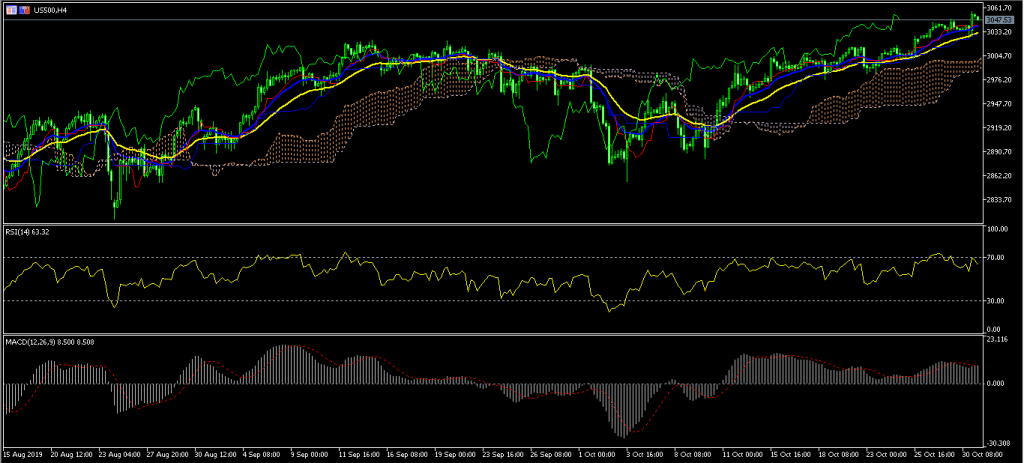

US500. The S&P500 rose yesterday after the decision by the Federal Reserve. The index reached an all-time high of $3057. On the four-hour chart, this price is above the 14-day and 28-day moving averages. It is also above the Ichimoku Cloud. The RSI remains slightly below the overbought level of 70 while the signal line of the MACD has flattened above the neutral line. The index may continue moving higher, especially after positive results by Apple.

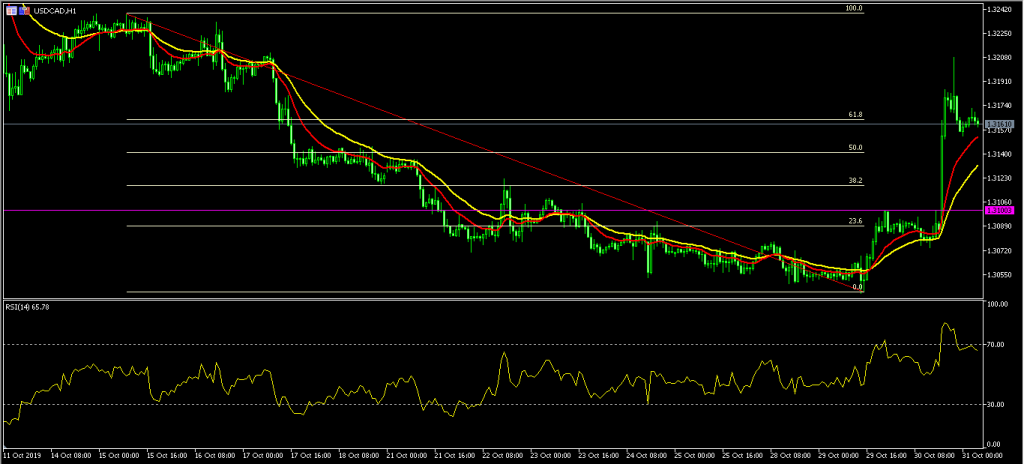

The USD/CAD rose sharply yesterday after the interest rate decisions of the Bank of Canada and the Federal Reserve. Yesterday, the BOC maintained the overnight rate at 1.75%. The bank left the Bank Rate at 2% and the deposit rate at 1.5%. This decision was in line with what the market was expecting. In the monetary policy statement, the bank said that the outlook of the global economy had weakened since July’s monetary policy report. The bank also said that it was expecting the Canadian economy to slow in the second half of the year. It also lowered its 2019, 2020, and 2021 growth outlook to 1.5%, 1.7%, and 1.8%.

The USD/CAD pair rose to a high of 1.3208 from the intraday low of 1.3040. The pair eased later in the day after the Fed decision. It is trading at 1.3160, which is along the 61.8% Fibonacci Retracement level. On the hourly chart, the price is above the 14-day and 28-day moving averages while the RSI has eased slightly from the overbought level of 70 to a low of 65. The pair may continue moving lower to the important support of 1.3100.

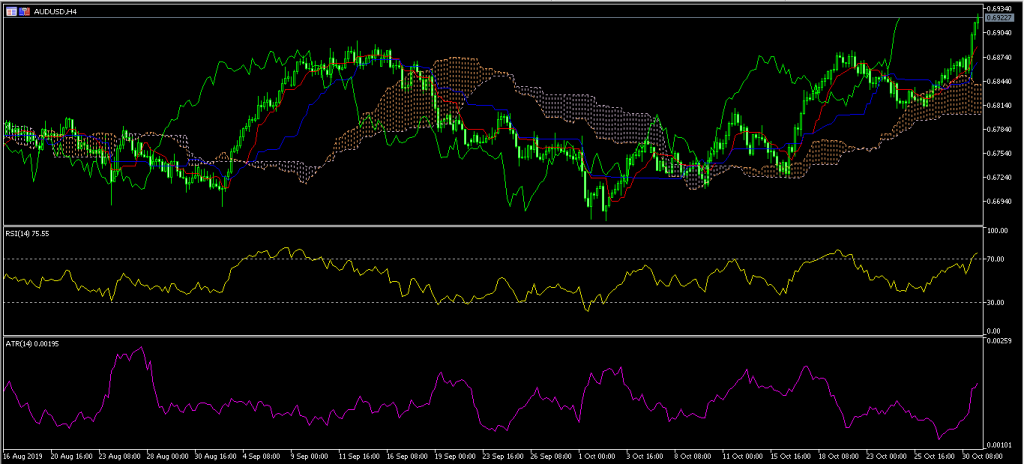

The AUD/USD pair rose as the USD weakened following the Fed decision. The pair rose after Australia released mixed economic data. In September, building approvals were unchanged. In the third quarter, the export price index rose by 1.3% after rising by 3.8% in the second quarter. The import price index rose by 0.4%, which was lower than the second quarter’s growth of 0.9%. Meanwhile, in China, data from the China Logistics Information Center showed that manufacturing PMI declined to 49.3 from the previous 49.8. Non-manufacturing PMI declined to 52.8 from the previous 53.7. The composite PMI declined to 52.0 from the previous 53.1.

The AUD/USD pair has been on an upward momentum in October. The pair rose from a low of 0.6668 to a high of 0.6930. On the four-hour chart, this price is higher than the Ichimoku Cloud. The RSI has risen to above the overbought level of 70. The average true range indicator has also been on an upward trend. The pair may continue moving upwards. However, it may also see some easing as a new month starts.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 22357