The Australian dollar rose in early trading as the markets waited for the interest rates decision by the country’s central bank. The bank is expected to leave rates unchanged and talk positively about the impact of previous rate cuts. Meanwhile, the currency reacted to weak retail sales numbers released by the Bureau of Statistics. In September, retail sales rose by 0.2%, which was lower than the consensus estimates of 0.5%. Sales rose by 0.4% in August. In the third quarter, retail sales declined by -0.1%, which was lower than the estimated increase of 0.2%. Traders also reacted to news that Westpac raised $1.7 billion as it seeks to plug a hole in its balance sheet after it posted the worst financial results in a decade. This news is significant because Westpac is the second biggest bank in the country.

The AUD/USD pair rose to a high of 0.6920. On the daily chart, this price is along the strong resistance line shown in blue. The signal line of MACD and histogram have soared while volatility has declined as shown by the average true range indicator. The price is above the 14-day and 28-day moving averages. The pair may have a pullback after it tests the important resistance level.

Dow futures declined in early trading as traders reacted to a series of news from the United States. On Sunday, McDonalds announced that it had fired the CEO, Steve Easterbrook, after he engaged in a relationship with a colleague. This was major news because, since Easterbrook became CEO in 2015, was accredited for doubling the company’s stock. The company is one of the components of the Dow Jones Industrial Average. Meanwhile, Under Armour’s stock will likely fall today after the Wall Street Journal reported that the company was facing federal accounting probes. The company is accused of shifting sales from quarter to quarter to appear healthier.

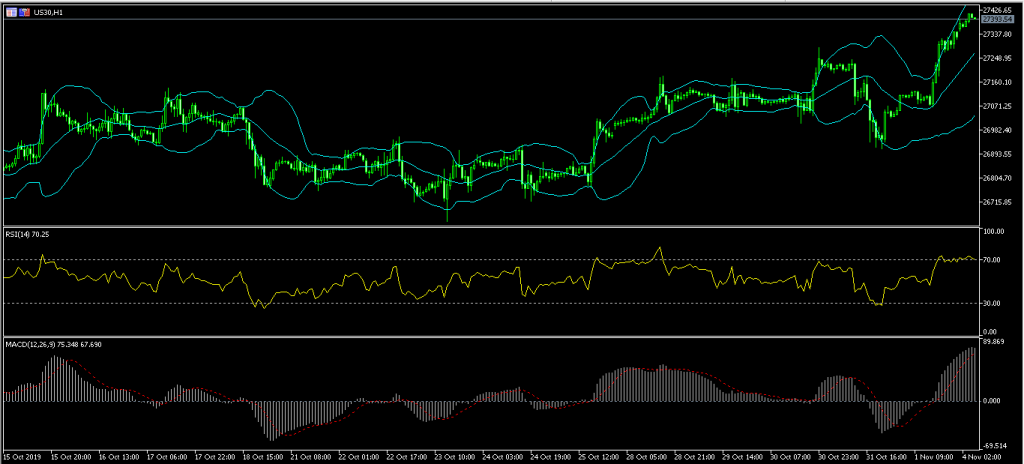

US30 index futures declined today after a series of negative news from the United States. The index, which had closed at an all-time high of $27,413, declined to a low of $27,394. On the hourly chart, the pair is trading slightly below the upper line of the Bollinger Bands. The RSI remains along the overbought level of 70. The signal and histogram of MACD has moved to the highest level in a few months. The index may have a pullback, as traders reflect on the recent earnings and emerging corporate news.

Chinese stocks continued the upward momentum as traders remained optimistic about US-China trade talks. They also received a boost from the US jobs numbers and PMI data from Caixin, which showed a pickup in activity. This has led Chinese stocks to become the best performers this year. In total, Shanghai and Shenzen stocks have added more than $1.4 trillion in market capitalisation this year. This is a 31% increase from where the year started. Later this week, the market will receive export and import data from the country.

The China A50 index rose today as the market remained optimistic about trade talks. The index is trading at Y14,242, which is the highest level since January 2018. On the daily chart, the index has established a triple top pattern and is above the 14-day and 28-day moving averages. The RSI has moved higher and is close to the overbought level of 70. The index may continue to move higher as hopes for a trade deal rise.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 22364