The Japanese yen strengthened slightly against the EUR as the markets reflected on the new stimulus package by Shinzo Abe. The $121 billion stimulus was the first since 2016 and will be used to repair the damage caused by the recent typhoon, upgrade infrastructure and invest in new technologies. These funds will be used in the next 15-months and are the biggest since the 2008/9 financial crisis. In recent months, the country’s economy has been dragged by the ongoing trade wars between the US and China and between South Korea and Japan. It has also been dragged by a recent rise in consumption tax. The impact of the latter was seen early today when the country released weak household spending and earnings data.

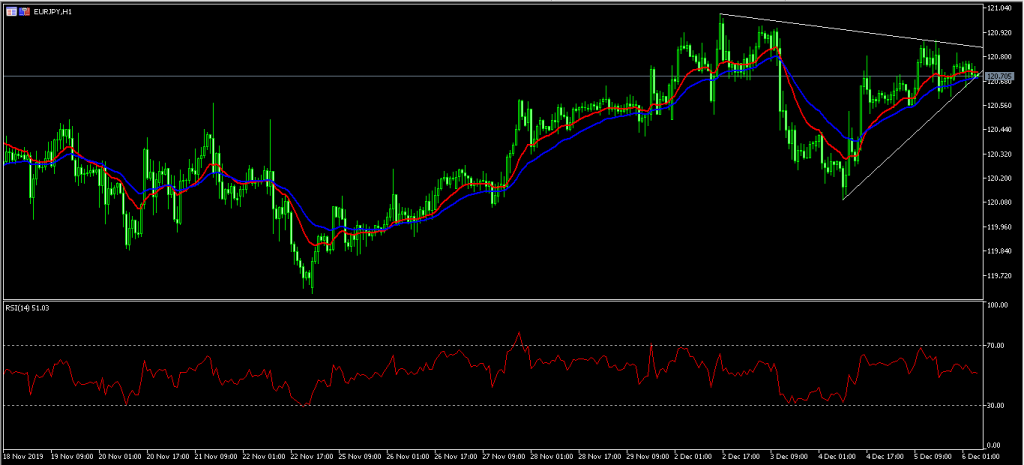

EUR/JPY Technical Analysis

The EUR/JPY pair declined slightly to a low of 120.70. The pair has formed a symmetric triangle pattern on the hourly chart. The price is along the 14-day and 28-day moving averages, which is an indicator of consolidation. This is confirmed by the flattening RSI, which is at 50. The pair may break out in either direction.

USD/CAD Falls Ahead of Employment Data

The USD/CAD pair declined as the markets waited for employment data from the two countries. The markets expect the US economy to have added 186k jobs in November after adding 128k in the previous month. Manufacturing payrolls are expected to rise by 38k while the average weekly hours are expected to remain unchanged at 34.4. Average hourly earnings are expected to remain unchanged at 3.0% while the unemployment rate is expected to remain unchanged at 3.6%. Meanwhile, in Canada, the economy is expected to have added 10k jobs in November while the unemployment rate is expected to remain unchanged at 5.5%.

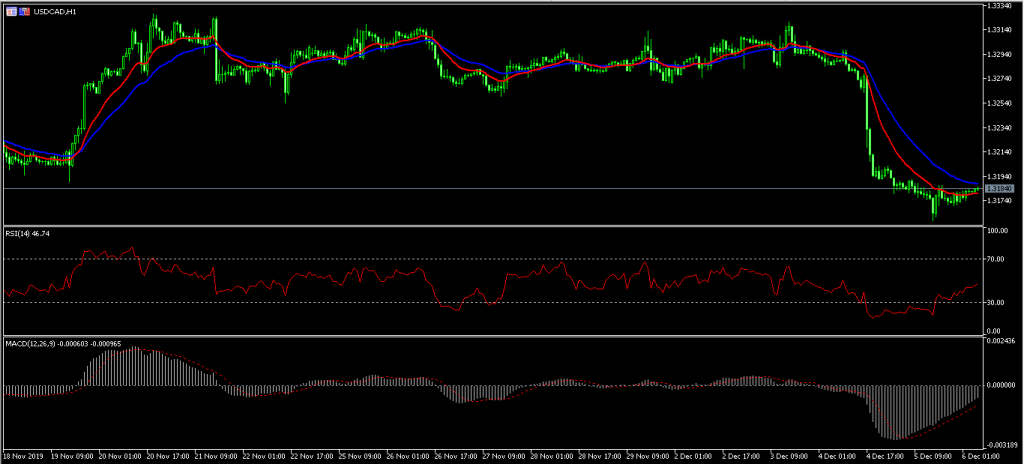

USD/CAD Technical Analysis

The USD/CAD pair has fallen from a high of 1.3320 to a low of 1.3157. This price is slightly below the 14-day exponential moving averages but slightly below the 28-day moving averages. The RSI has been moving upwards from a low of 14 to 65. The signal line of the MACD has been moving upwards. The pair may see some volatility today as the market receives employment data from the two countries.

Oil Price Struggles as OPEC Pledges More Cuts

The price of crude oil struggled as OPEC members agreed to more cuts on supply. After a day of negotiations, members agreed to deepen the current production cuts of 1.2 million barrels a day by 500k barrels. This means that members will cut production by 1.7 million barrels every day until March, when the deal will expire. At the same time, traders and analysts who attended the meeting warned that 500k cuts would not be enough to sway oil prices higher in a meaningful way. Meanwhile, OPEC+ members are still concerned about rising production from non-OPEC members like the United States. They are also concerned about non-compliance by members like Nigeria.

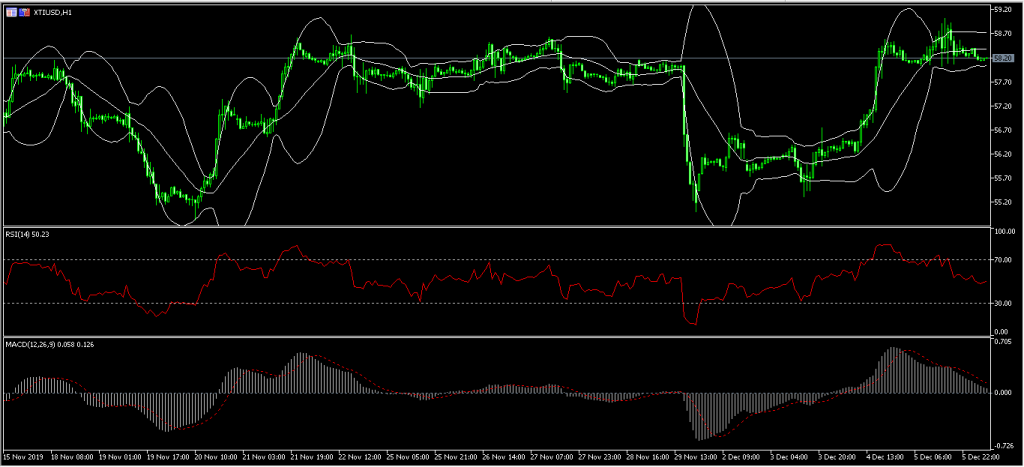

XTI/USD Technical Analysis

The XTI/USD pair declined slightly from a high of 59.02 to a low of 58.12. The price is still trading higher than the weekly low of 55.00. The price is between the lower and middle line of the Bollinger Bands while the RSI has been moving lower. The signal line of the MACD has been moving lower, which is a sign that the price may decline further.

Access 10,000+ financial instruments

Access 10,000+ financial instruments