The kiwi continued to strengthen against the Australian dollar after the market received better-than-expected data. Business confidence in New Zealand came in at -26.4, which was better than the expected decline of -30.8. Business activity increased by 12.9%, which was higher than October’s decline of -3.5%. These numbers came a day after the market received better-than-expected trade data and two days after the market received impressive retail sales numbers. Meanwhile, in Australia, the private new capital expenditure declined by -0.2% in the third quarter. Building capital expenditure rose by 2.7% while machinery capital expenditure declined by 3.5% in the third quarter.

The AUD/NZD pair moved to a low of 1.0524, which was the lowest level since August 26 this year. The price is below the 50-day and 28-day moving averages. The price is also below the oversold level of 30. The dots of the Parabolic SAR are above the current price. The momentum indicator is below the 100 level. The pair may continue to move lower. However, there is also a possibility of a turnaround as we start a new month.

The USD index was unchanged after the US released positive data. The second revision of US GD showed that the economy expanded by 2.1% in the third quarter. That was higher than the initial estimate of 1.9% and an increase from 2.0% in the second quarter. This revision, coupled with the better-than-expected durable goods orders may allay fears of a weakening US economy. Long-lasting manufacturing goods orders also rebounded in October from their steepest drop since May. These positive numbers helped power US stocks to all-time highs.

The USD/CHF pair has been on an upward trend since bottoming on November 18, when it traded at 0.9867. The pair reached a high of 1.0000 yesterday. It is now trading at 0.9990, which is slightly above the 28-day and 14-day moving averages on the hourly chart. The momentum indicator has moved below the important level of 100. The signal line of the MACD has stabilised above the neutral level. The pair may remain unchanged at these levels.

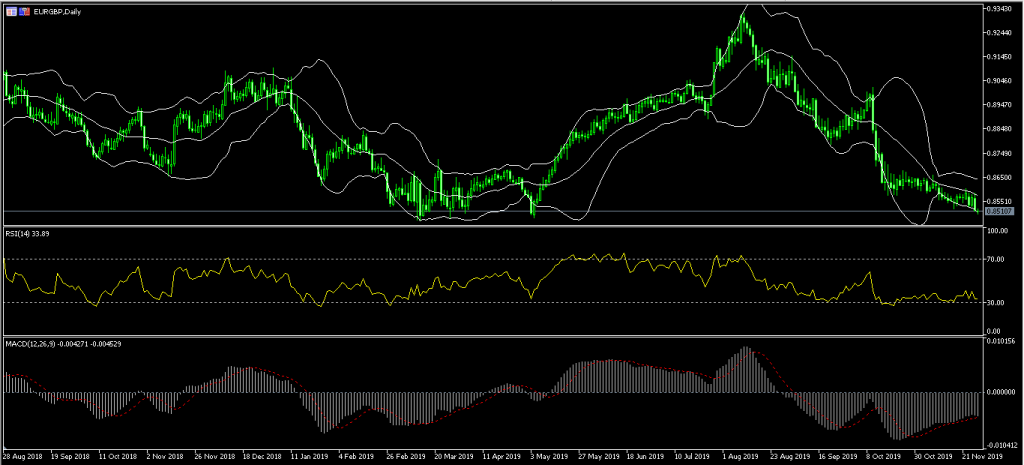

The euro declined sharply against the pound sterling ahead of key data from Europe. The market will receive the nationwide house price index from the UK. This number is expected to show that the HPI declined from 0.4% to 0.2% on an annualised basis. The market expects it to decline from 0.2% to 0.1%. The preliminary CPI data from Spain is expected to show a decline from 1.0% to 0.1%. The market expects Spain’s HICP to have declined from 0.7% to 0.6%. Meanwhile, in Sweden, the market expects retail sales to increase from 2.6% to 3.1% in October. Finally, the market will receive preliminary CPI data from Germany. They expect headline CPI to decline from 0.1% to -0.6% on a MoM basis.

The EUR/GBP pair declined to a low of 0.8450, which was the lowest level since May this year. The pair is now trading at 0.8510, which is trading along the lower line of the Bollinger Bands. The RSI has remained slightly above the oversold level of 30 while the signal line of MACD has moved below the oversold level. The pair may continue to move lower ahead of important data from Europe.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 22555