Gold powered to all-time highs following Powell’s inflation warning

Speaking at the Economic Club of Chicago, US Federal Reserve (Fed) Chairman Jerome Powell was in the spotlight yesterday and highlighted the potential economic consequences of President Donald Trump’s tariffs on the US economy.

‘Tariffs are highly likely to generate at least a temporary rise in inflation’

Powell underlined that Trump’s policy changes are ‘unlike anything in modern history and have put the central bank in uncharted waters’, adding that ‘the policies are still evolving and their effects on the economy remain highly uncertain’. He stated that the announced tariff increases were higher than anticipated, and that ‘the same is likely to be true of the economic effects, which will include higher inflation and slower growth’.

According to survey and market-based measures, near-term inflation expectations have increased, but longer-term inflation expectations remain ‘well anchored’. However, Powell said that ‘inflationary effects could be more persistent’.

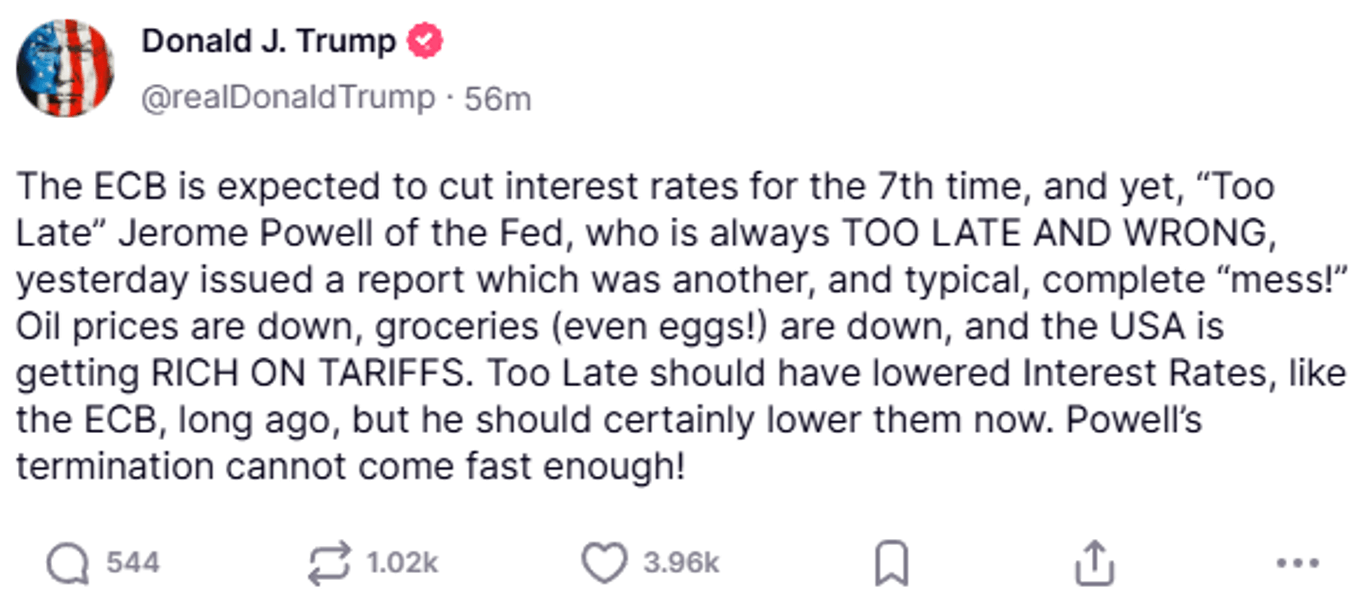

Powell indicated that a part of the tariff burden would be paid by the public, and unemployment is expected to rise as the economy cools. US President Donald Trump is clearly not a very happy chap this morning regarding Powell’s recent remarks, noting that the Fed Chairman’s termination ‘cannot come fast enough’:

Fed on hold for now

Powell stressed that the Fed’s best course of action right now is to remain on hold until data reveals a clearer path. He noted that the central bank is ‘well-positioned to wait for greater clarity before considering any adjustments to our policy stance’. Despite this, Powell refrained from providing any indication as to the future rate path. Markets are pricing in nearly 90 basis points (bps) of easing this year, so the expectation is for about three rate cuts by the end of the year, with June or July’s meeting on the table for a potential 25 bp cut.

Providing a more candid perspective on the new government, Powell remarked that the effects of the administration’s tariffs may steer them away from their objectives, indicating that the Fed could face a conflicted mandate – maximum employment and stable prices. He stated that if this conflict comes to fruition, ‘we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close’.

Gold: Buy the dip?

Powell’s comments immediately guided US equities southbound and underpinned a bid in the price of Spot Gold to yet another fresh all-time high, with price action currently trading off highs of US$3,574 ahead of the US cash open.

With Goldman Sachs and UBS raising their year-end Gold price forecasts, and the trend evidently to the upside, this would be a challenging market to short at this point.

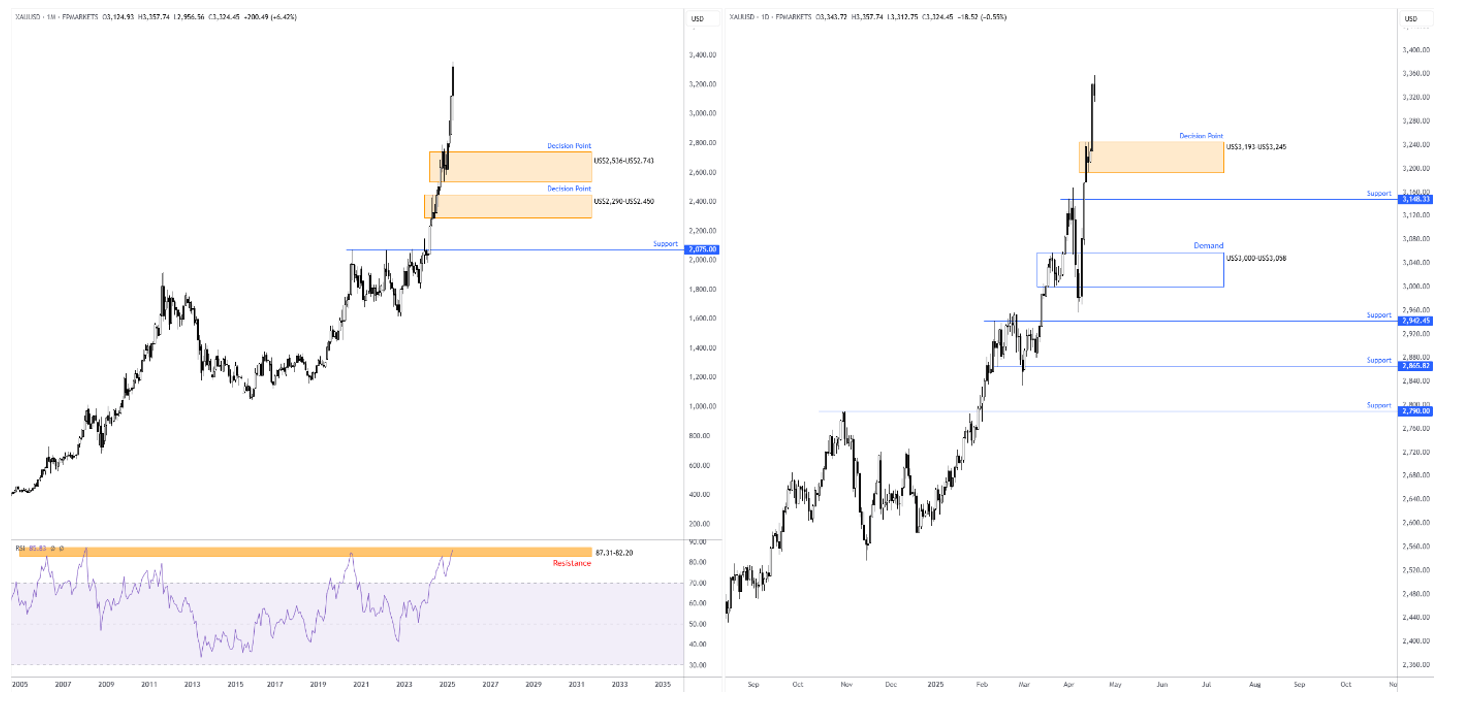

Despite the yellow metal registering long-term overbought conditions – the monthly chart’s Relative Strength Index is testing levels not seen since 2008 – picking tops in a trend demonstrating strong momentum at all-time highs is difficult.

Consequently, investors will likely seek dip-buying opportunities. I am seeing very little support to work with on the monthly scale right now, though the daily chart highlights an interesting decision point zone at US$3,193-US$3,245, located just north of notable support from US$3,148. The daily demand zone at US$3,000-US$3,058 is also a worthwhile base to pencil in the watchlist. Ultimately, if a correction should materialise from current levels, I will watch how price behaves at US$3,193-US$3,245, given I believe that this area warrants some caution due the possibility of a whipsaw through the noted area (tripping stops) into US$3,148.

Charts created using TradingView

Written by FP Markets Chief Market Analyst Aaron Hill

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.