Beginner's Guide to Low-Risk Investments

Reading time: 7 minutes

For those who prioritise capital preservation as a part of their investment strategy, low-risk investment options can be a wise choice.

What are the most popular low-risk investments?

What are their advantages and limits?

Let's dive in.

Savings Accounts

Savings accounts are similar to normal bank accounts but pay interest on deposits.

Pros of savings accounts

- Available almost everywhere.

- Help beginner investors set aside money to reach their short-term financial goals (creating emergency funds, house down payment, etc.).

- Allow you to start small if you can’t save much.

- A safe option, as deposits are insured.

- Some accounts offer high-interest options, such as high-yield savings accounts.

- Your money is usually always available.

- There are generally no maintenance fees.

- Compounding.

Cons of savings accounts

- Because savings accounts are lower risk than many other products, investment returns are also limited.

- You can only save a certain amount of money.

- Minimum investment or balance.

Certificates of Deposit (CDs)

CDs are a type of savings account in which you need to keep your money locked in for a certain period of time.

Pros of CDs

- Offer higher interest rates than traditional savings accounts.

- Predictable returns.

- Deposits are insured.

- There are no maintenance fees.

Cons of CDs

- No withdrawals are allowed for a given period (unless you're ready to pay early withdrawal fees).

- You can only save a certain amount of money.

- Relatively low returns.

Money Market Funds

Money market funds are a type of mutual fund that invests in highly liquid debt instruments with short maturity or cash and cash equivalent products.

Pros of money market funds

- Suitable for short-term investments.

- Secure and highly liquid investment option.

- Higher returns than similar investment vehicles, such as savings accounts.

- Low initial investment.

- There are different types of money market funds available (prime money fund, Treasury fund, government money fund, etc.).

Cons of money market funds

- Generate income but little capital appreciation.

- Low-return investments.

- Sometimes, there is a limited tax deduction.

- Funds not insured.

Retirement Plans

Retirement savings plans are specific schemes that allow you to maximise your savings in order to prepare for your retirement.

Pros of retirement plans

- Long-term saving and investing options.

- There are many retirement saving schemes available that come in different forms (individual retirement accounts vs. employer-sponsored accounts).

- Various investment possibilities exist, depending on your risk profile.

- Range of tax advantages (tax breaks, tax-free withdrawals, etc.).

- Death benefit to beneficiaries is possible.

- You can get a contribution from your employer.

- You can decide how to get paid once you retire (a lump sum or annuity).

Cons of retirement plans

- It might be difficult to anticipate your expenses and needs once you retire.

- Sometimes, there is a limited tax deduction.

Treasury Securities

Treasury securities are US government debt securities that can be either Treasury bills, Treasury bonds , or Treasury notes. How they are classified depends on their duration. Note that many other countries have similar government bonds; the UK, for example, offers Gilts.

Pros of Treasury securities

- They are considered one of the safest investments, backed by the US government.

- Low volatility.

- Stable income.

- Tax benefits are available under certain conditions.

- There are three different types of securities to invest in, depending on your time horizon.

Cons of Treasury securities

- Inflation and interest rates can pose risks.

- Limited returns.

Exchange-Traded Funds (ETFs)

ETFs are like index funds that track the value of a basket of select securities.

Pros of ETFs

- Popular investment option among beginners.

- Low-cost option offering immediate exposure to a range of assets or markets.

- Liquid and transparent investment vehicle.

- Easy product to invest in through brokerage accounts and investment apps.

- Various ETFs (inverse, leverage, currency, commodity, bond, industry, and stock ETFs, among others).

Cons of ETFs

- Depending on the markets targeted, investing in ETFs can come with a higher level of risk.

- Tracking errors showing the difference in return between the assets or markets tracked and the ETFs.

- Capital gains taxes.

- Market loss.

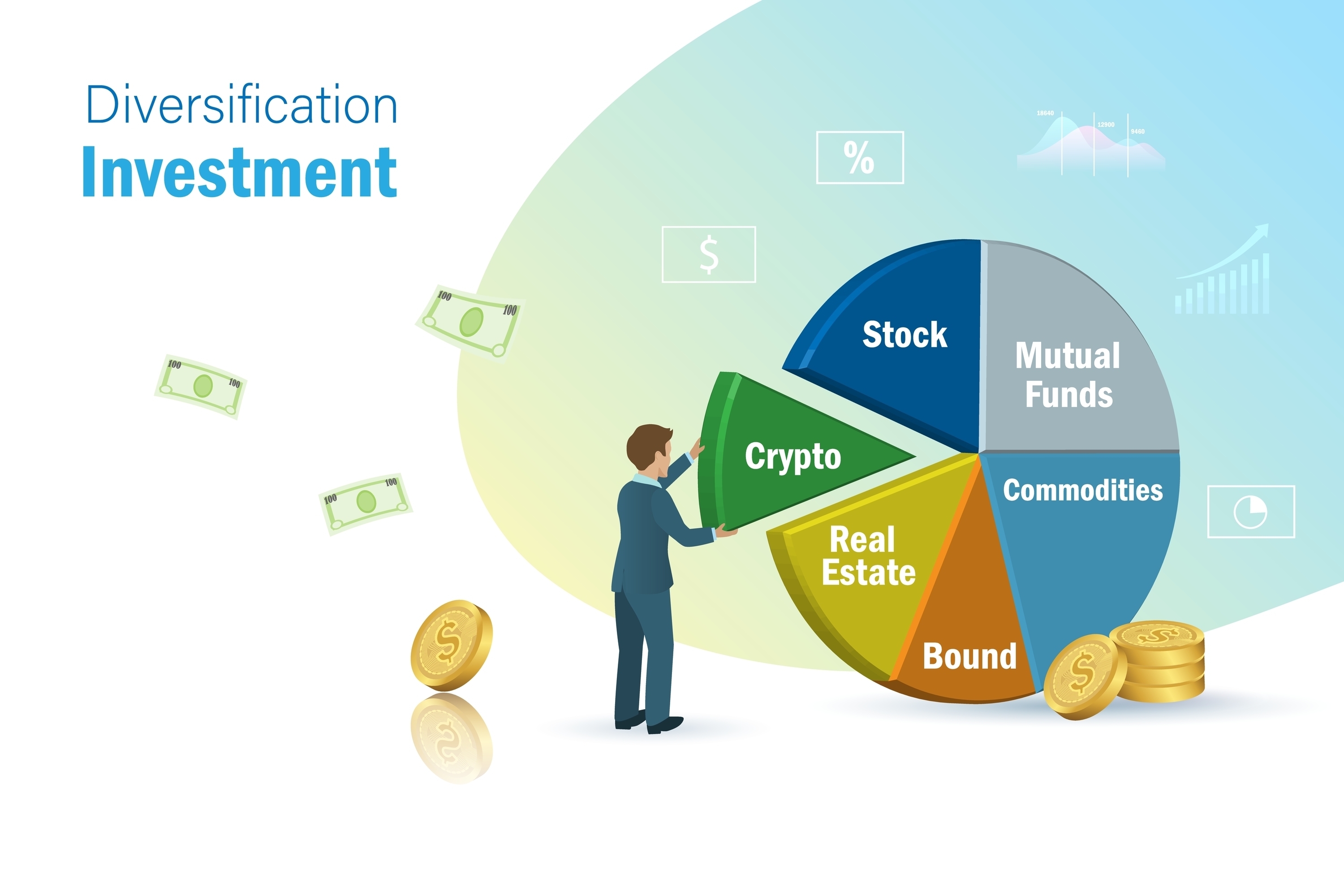

The Importance of Diversification

When thinking about the ideal allocation of your portfolio, remember to always diversify your holdings by investing in different asset classes (stocks, bonds, real estate, etc.) while also taking into account changing market conditions . It will help you reduce the impact of volatility and lower the overall level of risk associated with your investment vehicles.

If you’d like to get financial advice for creating a diversified portfolio according to your risk tolerance and your long-term investment goals, contacting a financial advisor before investing can be a wise choice. In the meantime, check out FP Markets’ educational content, in place to help you enhance your investment knowledge.