UK Inflation Slows in February; GBP Lower Ahead of Spring Statement

As reported by the Office for National Statistics (ONS), UK CPI inflation (Consumer Price Index) cooled by more than expected in February across key measures, immediately sending the British pound (GBP) to the downside and underpinning a bid in UK stock markets.

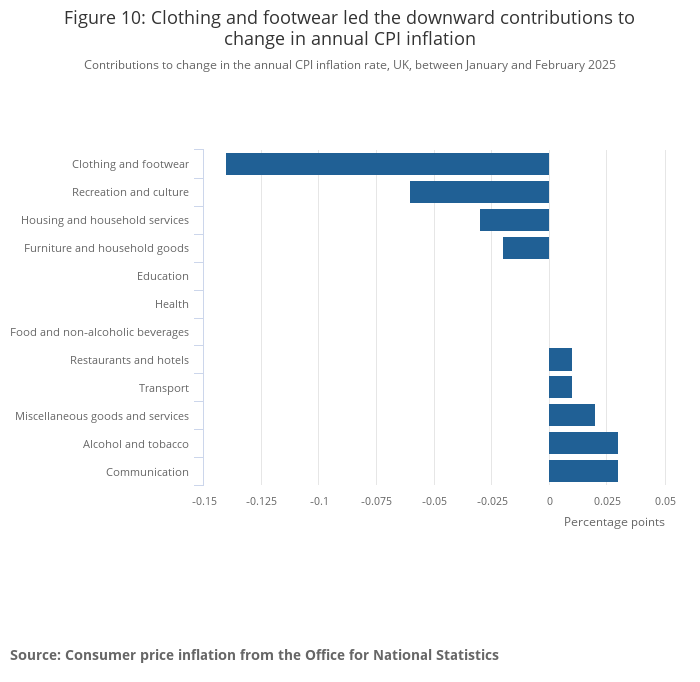

The ONS noted that the largest downward influence to prices came from ‘clothing and footwear’, adding that downward contributions from four divisions were partially offset by upward price rises in five categories.

UK Inflation Eases by More Than Expected

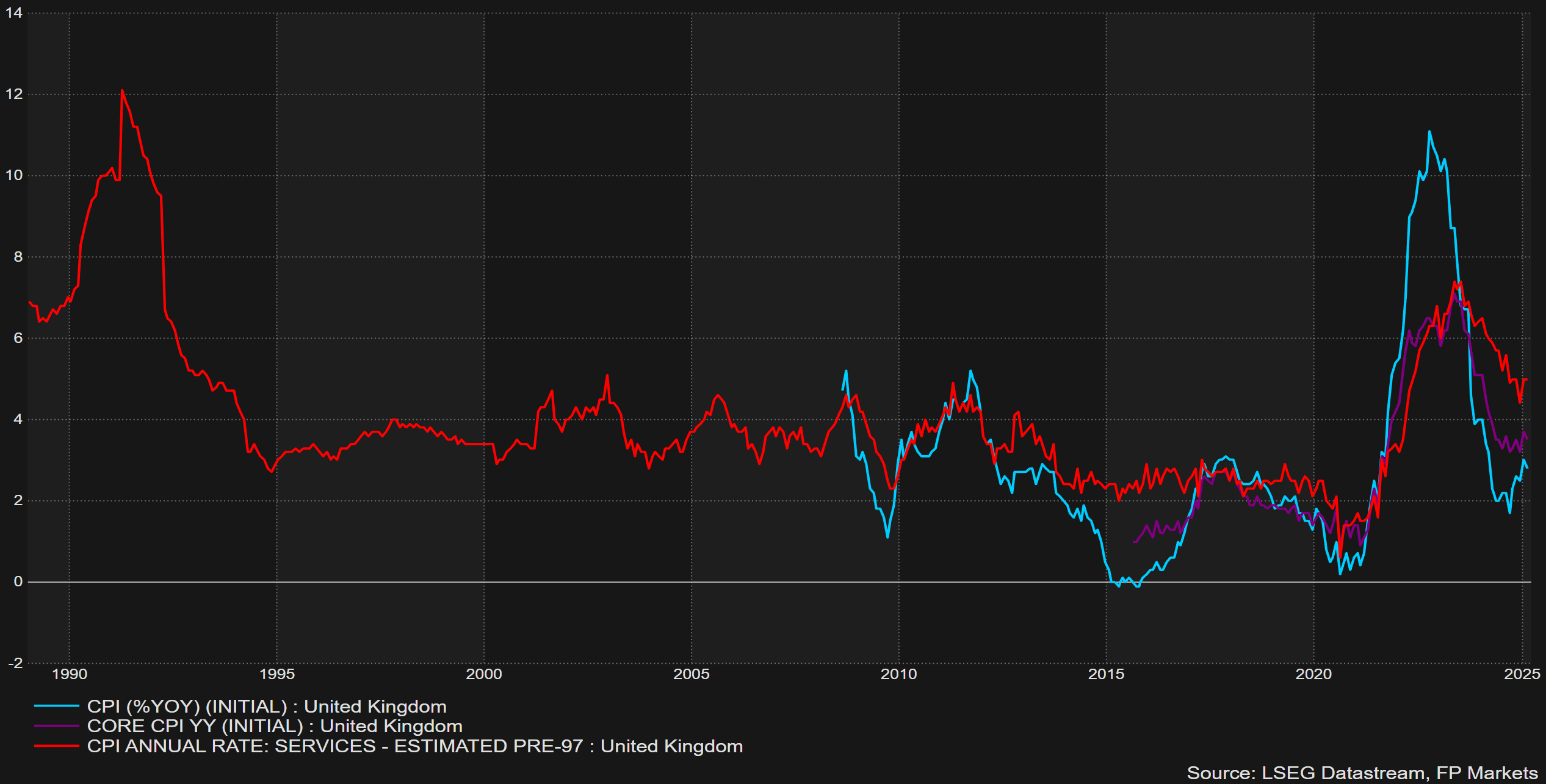

Headline CPI reported an increase of 2.8% year-on-year (YY) in February, below the 3.0% reading in January and just south of the market’s median estimate of 2.9%. Core YY CPI rose by 3.5%, down from 3.7% in January and below consensus of 3.6%. Month-on-month (MM) CPI data increased by 0.4% for both headline and core measures (versus 0.5% expected), up from -0.1% and -0.4%, respectively. On the services side, MM inflation came in as expected, rising 0.5% from -0.2%, while YY services inflation increased by more than expected (4.9%) to 5.0%, matching January’s data.

You will recall that the Bank of England (BoE) maintained the bank rate at 4.50% last week and made it clear they’re in no hurry to begin cutting rates again at this point. The accompanying rate statement noted that a ‘gradual and careful’ approach to easing policy was appropriate.

Although inflation showed signs of easing in both headline and core measures in February, it remains too high to prompt significant changes in policy. I expect the BoE to maintain its current stance for the time being, especially given the global uncertainties stemming from US tariffs. You may recall that the BoE's quarterly projections, released in February, also indicated that inflation is expected to rise in the near term, reaching 3.7% in Q3 25. As of writing, investors are pricing in a possible cut for June’s policy meeting (-22 basis points [bps] priced in), with around 45 bps priced in for the year.

UK Spring Statement Ahead; GBP Lower

At approximately 12:30 pm GMT today, UK Chancellor Rachel Reeves will deliver her Spring Statement to Parliament. With the latest inflation data providing her somewhat of a boost, Reeves is widely expected to announce a spending squeeze and lay the majority of the blame on global market uncertainty. We’re also likely to hear that the Chancellor’s fiscal headroom of approximately £10 billion has been wiped out, with sizeable downward forecasts to growth also expected.

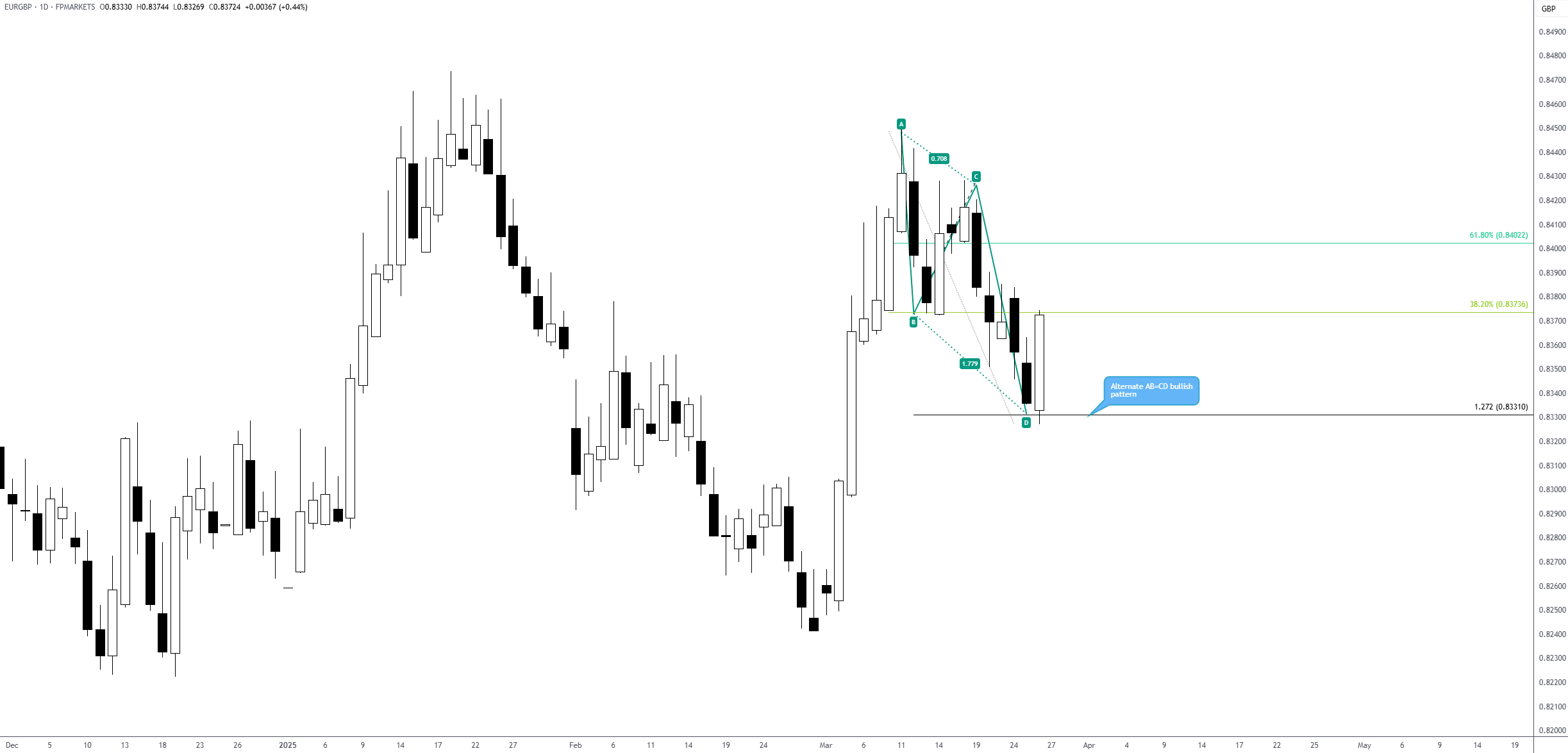

For those who followed this morning’s Chart of the Day, you will note our Team highlighted possible GBP weakness on the EUR/GBP (euro versus the British pound), based on an ‘alternate’ AB=CD bullish formation on the daily timeframe at £0.8331 – a 1.272% Fibonacci projection ratio. It has printed quite the move since and, as you can see from the chart below, is currently bumping heads with the underside of the 38.2% Fibonacci retracement value at £0.8374, a common upside objective derived from legs A-D. You will find that some traders tend to reduce risk to breakeven at this point (likely even more so right now given possible volatility from the upcoming Spring Statement) and take some profit off the table to let the remainder of the position run to the 61.8% Fibonacci retracement value of £0.8402 as a final profit objective, also derived from legs A-D.

Chart created using TradingView

Written by FP Markets Market Analyst Aaron Hill

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.