A swap rate, which is also known as a rollover rate, is the rate applied when a trader chooses to hold a position overnight. The swap rate comes at a cost or as a gain to the trader depending on the prevailing interest rates and it will either be a positive or a negative number. If the rate is positive, it’s a gain for the trader (it’s added to the account) and if it’s negative it’s a cost for the trader (it’s deducted from the account). Swap rates vary by asset and since various market conditions, such as

Swap Rate: Definition and How it is Calculated

Swap Rate:

Definition and

How it is

Calculated

When it comes to the financial markets, a sound understanding of how things work is one of the aspects that will determine how well you do in your trading career. You need to accumulate knowledge of trading fundamentals and any trading terms you will likely come across as you trade.

One of the fundamentals you need to understand is the use of swap rates. In addition to spreads, these rates will affect your account balance and how much of your profits you get to keep. With this in mind, this article takes a look at swap rates; what they are and how you can calculate them.

What is a Swap Rate?

What is a Swap Rate?

volatility, influence them, they fluctuate constantly. Also, because various big financial institutions issue the interest rates on which swap rates are based, different brokers will have slightly different rates depending on the financial institutions they work with.

Note: The measure for swap rates is one standard lot. For instance, one standard lot for forex pairs is 100,000 units of currency.

Why do

Traders Hold

Positions Overnight?

Traders typically hold their positions overnight in the hopes that their profits will increase or that a losing trade will reduce or become profitable the following day. In other cases, an overnight position may result from insufficient knowledge of the market. A trader may end up holding a position overnight because they don’t know that a trade that extends beyond the typical trading hours results in a rollover.

When is a

Rollover

Booked?

Brokers apply the swap rate to all trades left open overnight. For example, the market considers 5:00pm EST (10:00pm GMT) the beginning and end of the forex trading day. If a trader enters a position on Monday at 4:55pm EST and closes it at 5:10pm, the broker considers it an overnight position. However, a trade opened at 5:01pm. on Monday is not subject to rollover until 5:00pm on Tuesday. The net interest earned or deducted for each position that is held overnight is applied directly to the trader’s account.

How are Swap

Rates

Calculated When

Trading Forex?

For forex trading, you calculate the swap rates based on the interest rate differential between the currencies being traded – that is, the rate at which you would exchange interest in one currency for interest in the other currency.

Forex trading is essentially the buying or selling of a currency for another with a view to ‘swap’ the currency back later with the broker. When you don’t swap back that currency at the end of trading hours, you have to pay the broker to allow you to hold your position and do the swap later. Depending on the currency pair being traded and the current prevailing interest rates, the swap rates will either be negative or positive.

Calculating the Rate for Forex

Calculating the

Rate for Forex

Before calculating the rate, it’s important to understand what the interest rate differentials mean. Generally, when the interest rate of the country whose currency you are buying is more than the interest rate of the country whose currency you are selling, the broker will credit your account with the difference. Conversely, when the interest rate of the country whose currency you are selling is more than the interest rate of the country whose currency you are buying, your account will show a deduction for the difference. Note: Brokers may deduct a mark-up fee in addition to the difference that they add to or subtract from your account. As such, your final account balance may end up being lower than if there were no additional fees.

Note: Brokers may deduct a mark-up fee in addition to the difference that they add to or subtract from your account. As such, your final account balance may end up being lower than if there were no additional fees.

Short position

Let’s say that the EUR/USD is trading at 1.2500, the USD federal funds rate is 2.5%, and the European Central Bank’s interest rate is 3.25%. If you open a short position (sell) on the EUR/USD for 1 lot, you are essentially selling €100,000, borrowing it at an interest rate of 3.25%. By selling EUR/USD, you’re buying USD, which earns a 2.5% interest rate. The interest rate differential is 0.75.

Now let’s say your broker charges a 0.25% mark-up for the swap. Since the interest rate of the currency you are selling (EUR) is higher than that of the currency you are buying (USD), you add the mark-up in the formula. If you add this to the 0.75% interest rate differential, the total interest the broker charges is 1.00%.

For this example, we use a 365-day year but some brokers will typically use 360 days. Others will use both 365 days and 360 days depending on the instrument being traded. Using the formula:

-

Swap rate = (Contract x [Interest rate differential

+ Broker’s mark-up] /100) x (Price/Number of

days per year) -

Swap Short = (100,000 x [0.75 + 0.25] /100)

x (1.2500/365) -

Swap Short = USD 3.42

-

Swap rate = (Contract x [Interest rate differential + Broker’s mark-up] /100) x (Price/Number of days per year)

-

Swap Short = (100,000 x [0.75 + 0.25] /100) x (1.2500/365)

-

Swap Short = USD 3.42

In this case, you are selling the EUR and its interest rate is higher than the USD one, therefore, the USD 3.42 is deducted from your account when your EUR/USD position rolls over to the next day.

Long position

Using the previous example, for a buy position: By going long on the EUR/USD you would be buying EUR and selling USD. This means that you would essentially be buying €100,000 which earns an interest of 3.25% using USD with a 2.5% interest rate. If the broker charges a 0.25% mark-up, you will subtract it from the formula since the interest rate of the currency you are selling is lower than that of the currency you are buying. Using the formula:

-

Swap rate = (Contract x [Interest rate differential

- Broker’s mark-up] /100) x (Price/Number of days

per year) -

Swap Long = (100,000 x [0.75 – 0.25] /100) x

(1.2500/365) -

Swap Long = USD 1.71

-

Swap rate = (Contract x [Interest rate differential - Broker’s mark-up] /100) x (Price/Number of days per year)

-

Swap Long = (100,000 x [0.75 – 0.25] /100) x (1.2500/365)

-

Swap Long = USD 1.71

Here you are buying the EUR and its interest rate is higher than the USD one, therefore, the USD 1.71 is credited to your account when your EUR/USD position rolls over to the next day.

Note: If the difference between the interest rates is equal to or smaller than the broker’s mark-up, you will still be charged for the buy position.

Interpreting the calculation

Interpreting the calculation

With a bigger lot size, the swap costs will also increase significantly. This means that before you decided to hold a position, you can use the calculation to estimate how much it will cost you to hold a position for a certain period. That way, you are better prepared to anticipate how long you can afford to remain in the trade before it becomes unprofitable. However, this is all assuming that the interest rates remain fairly constant.

What are the Limitations of

Using the Calculation?

What are the

Limitations of Using

the Calculation?

In most cases, there is a difference between the rollover rates calculated by traders and those charged by brokers. This is because the short-term interest rates of currencies depend on various factors including:

Market behaviour

The current interest rates in the two countries whose currencies you are trading

The price movements of the currency pairs

The swap rates provided by a broker’s counterparty

Is There a Limit to How

Long you Can Hold a

Forex Position For?

When trading the forex market, it’s possible to hold a position for as long as you want – from a couple of minutes to days and even months. Nonetheless, since the forex market closes every day at 5pm EST, each time you go over this time your broker will charge a fee. As such, it’s prudent to calculate how much you will have to pay for holding your position for a longer period before you commit to it.

Understanding Forex Swap Rates:

Understanding

Forex Swap Rates:

Step 1 | What is a Triple Swap?

The markets close over the weekend so, ideally, there should be no rollover on these days. However, banks still calculate interest even on positions held over the weekend so the market applies three days of rollover on Wednesdays to cover the rates for the weekend. This means that if you decide to hold a position overnight on a Wednesday, you will incur triple swap rates.

You should note that you will incur the triple charge if you keep an open position overnight on Wednesday regardless of whether you actually have any trade open during the weekend. For example, if you open a trade on Monday and you close it on Thursday, your broker will charge for five nights instead of three (the three nights from Monday to Wednesday plus the two weekend nights).

Brokers charge triple swap rates on Wednesday because forex contracts have a two-day settlement timeframe. For instance, a forex contract from Monday settles on Wednesday while one from Tuesday settles on Thursday and one from Wednesday settles on Friday. However, because the market is closed on Saturday and Sunday, a contract you open on Thursday will only be settled on Monday. This means that any position left open on Wednesday (after 5 pm EST) rolls over to Thursday and it can’t be settled until the following week hence the triple charge.

Note: Some brokers have opted to charge triple swaps on Fridays or even Thursdays instead of Wednesdays. In view of this, it’s important to know your broker’s terms and conditions when it comes to the triple charge.

Step 2 | CFD Swap Rates

You can calculate index CFD swap rates based on the short-term interest rates (up to three months) of the base currency of the associated index. For example, the base currency for the FTSE 100 is the GBP and the index uses the short-term London Inter-Bank Offered Rate (LIBOR). Similarly, the ASX200 base currency is the AUD and the index bases its interest rate on short-term Bankers’ Acceptance bills.

Commodity CFD swap rates are a combination of different factors that relate to holding a commodity position. However, although metals fall under commodities, their swap rates can be calculated the same way as those for forex.

Note: In some cases, the swap rate calculation of copper is dissimilar to that of other metals because some brokers exclude copper from metals and have it under commodities.

What if you Don’t Want to

Calculate the Swap Rate?

What if you Don’t

Want to Calculate the

Swap Rate?

Most brokers offer updated rollover rates on their sites so you don’t necessarily have to calculate them. Some brokers also offer a swap rate calculator tool if you want to simplify the calculation process. There are different rates for long and short positions. This means that if you place a short position (sell), you will use the ‘Swap Short’ rate and if you place a long position (buy), you will use the ‘Swap Long’ rate.

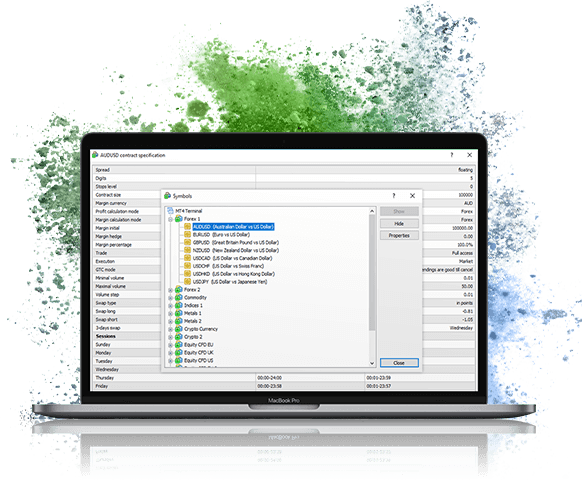

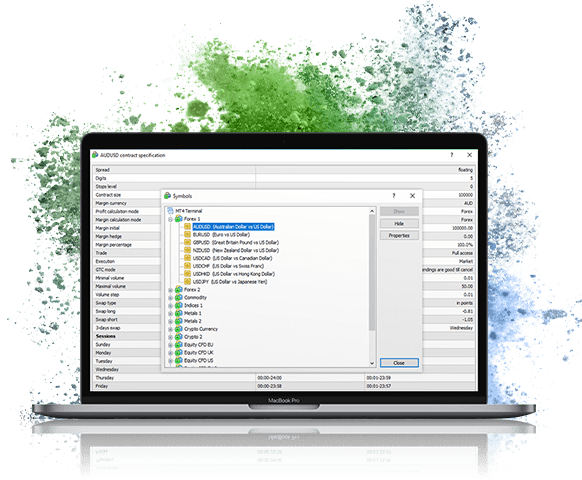

If your broker doesn’t offer the swap rates on their site, you can use MetaTrader 4 (MT4) or MetaTrader 5 (MT5) to get the rates. The rates are under the ‘Market Watch’ section where you can choose the rate for your desired instrument. For example, to get the rate in MT4:

Select the ‘Market Watch’ section.

Right-click on your desired asset to reveal the asset’s drop-down menu.

From the drop-down menu, select ‘Symbols’. This will open a popup window that provides the specifications for all the available instruments.

Choose the instrument you want to check then select ‘Properties’. This will open a new window showing an instrument’s short and long swap rates.

Applying Swap Rates to your Trading

Applying Swap

Rates to your

Trading

Understanding how swap rates work will help you understand the true cost of your trading and how to plan your trades better. You will be able to quantify your risks and rewards before you even trade, putting you in a position to make well-informed and educated decisions that will increase your chances of succeeding in the markets.