The Australian dollar declined after the country released trade data for September. Numbers from the Australian Bureau of Statistics (ABS) showed that exports, imports, and trade surplus increased in September. Goods and services exports rose by 3% in seasonally-adjusted terms while imports rose by 3%. Trade surplus increased by more than $7.18 billion on seasonally-adjusted terms. This was a $563 million increase from the previous month. The housing sector numbers were not good. Total dwelling units approved declined by 0.8% in September.

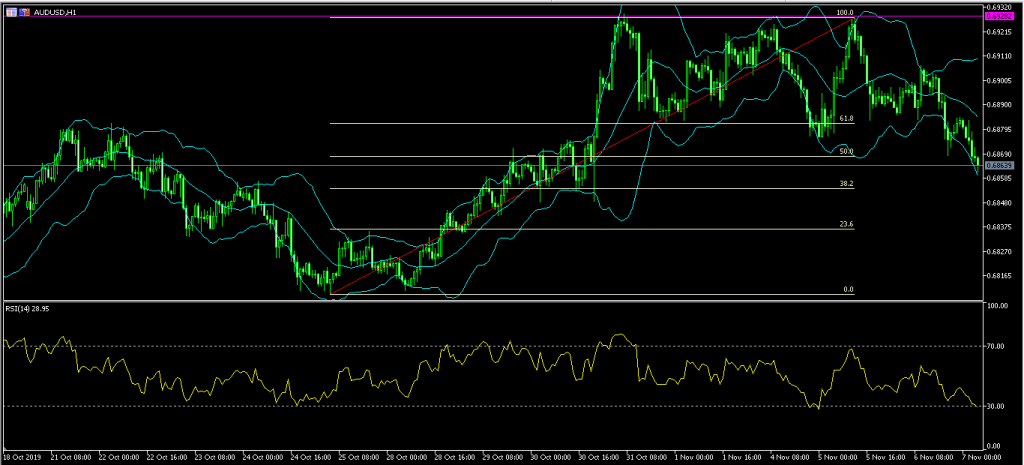

The AUD/USD pair declined sharply after the housing and trade numbers. The pair has been on a downward trend after forming a strong double top at the 0.6930 level. On the hourly chart, the pair is trading along the lower line of the Bollinger Bands. The RSI dropped to a low of 30 while the pair is below the 50% Fibonacci Retracement level. The pair may continue the downward trend.

Sterling continued declining against the USD as the market waited for a decision by the Bank of England. The bank started its monetary policy meeting yesterday and is expected to release its decision today. Traders expect the bank to leave rates unchanged at 0.75%. This will be the first rates decision after Johnson called for an election. The meeting also comes a week after the Federal Reserve made the third rates cut. In recent weeks, manufacturing, factory, inflation, and employment data from the UK has been relatively weaker as companies pause on spending.

The GBP/USD pair has been on a downward trend since Monday this week. The pair has dropped from a high of 1.2972 to a low of 1.2836. On the 30-minutes chart, the pair is trading below the 14-day and 28-day moving averages. The pair has also formed a descending channel as shown below. The momentum indicator remains below the 100 line. The pair may continue moving lower to test the 1.2825 level.

Gold price declined on Monday and Tuesday as the market remained optimistic about trade talks between the US and China. As stocks rose, rotation from gold seemed like a good option. Yesterday, gold price rose as questions emerged over the likelihood of a trade deal. A deal would see China commit to more US goods purchases. It would also see the country commit to IP protections. The US would remove some tariffs from Chinese goods. However, an emboldened China has asked the US to ease more tariffs. This means that there is a long path towards a deal.

The XAU/USD pair dropped sharply on Monday as hopes of a trade deal increased. In the past two days, the pair has moved up from a low of 1479.28 to a high of 1494. On the hourly chart, the price is slightly below the 14-day and 28-day moving average. The RSI has moved higher from a low of 18 to a neutral rate of 52. The momentum indicator is slightly above the 100 level. The pair may continue moving higher today.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 22361