The kiwi jumped after the RBNZ delivered its interest rates decision. The market was expecting the bank to slash rates by 25 basis points but interest rates were left unchanged. In a statement, Governor Adrian Orr said that developments had not changed since the August statement. Members also noted that there were significant downside risks to the economy. Employment remains close to its maximum sustainable level while inflation remains below the 2% target. Members were also concerned about the slowing global growth, which was affecting external demand. By leaving rates unchanged, the bank said it was ready to intervene if conditions weakened.

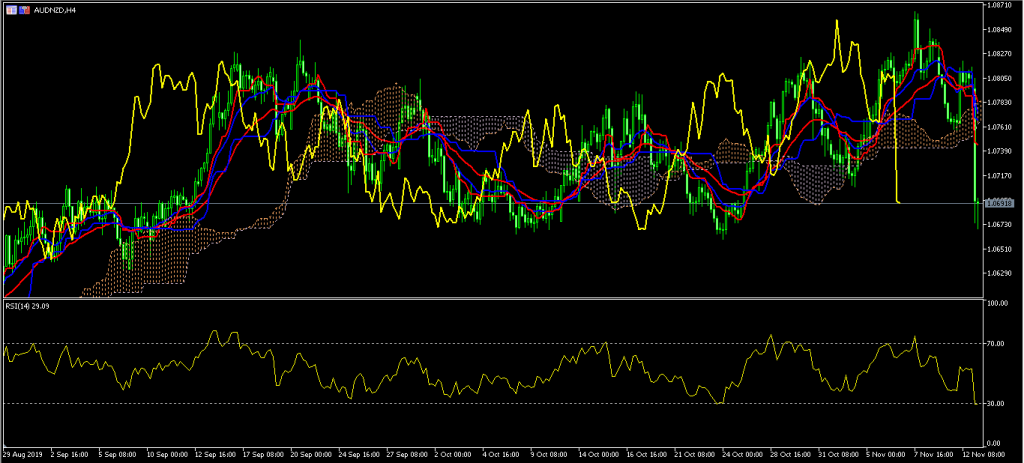

The AUD/NZD pair declined sharply to a low of 1.0668. This was a significant low from this week’s high of 1.0865. On the four-hour chart, the RSI has moved to below the oversold level of 30. The pair has remained below the short and medium-term moving averages. It is also below the Ichimoku Cloud. The pair may attempt to recover from the day’s drop. As such, it may move upwards ahead of a statement by Adrian Orr.

Hong Kong stocks declined sharply as violent protests continued. The police warned that the city was on the brink of total collapse as civilians and police engaged in running battles. The new round of violence was caused by the recent killing of protesters by the police. The city remains in a dire state, with the MTR, major roads, and schools remaining closed. Hong Kong is an important city in Asia, which is often viewed as a gateway to China. However, the recent protests have made the city ungovernable and pushed it into a recession.

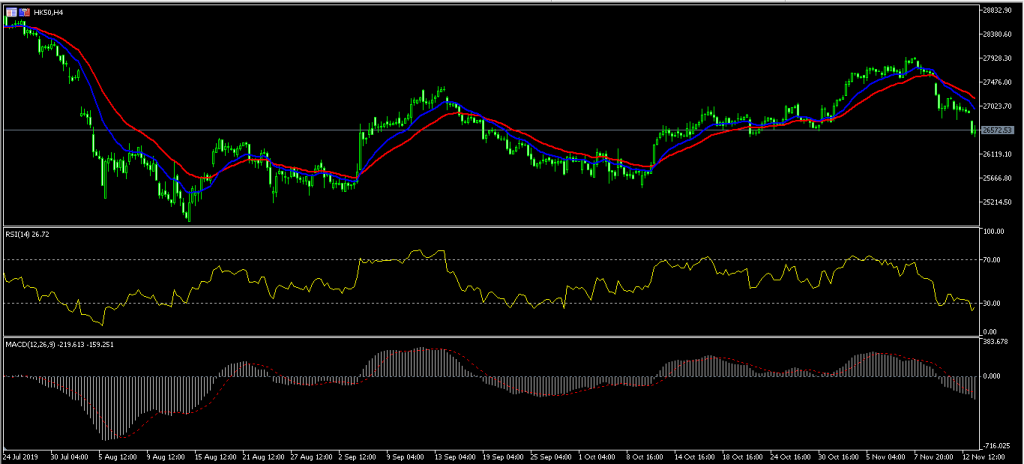

The HK50 index has been on a downward trend this week. The pair reached a high of $27,970 and then moved to a low of $26,440. On the four-hour chart, the price is below the 14-day and 28-day moving averages. The RSI has moved to below the oversold level of 30. The signal line of the MACD has been on a downward trend as well. The index may continue to decline as the market remains wary of the city.

The EUR/USD pair paused as the market waited for a statement from the Federal Reserve Chair, Jerome Powell. Jerome will be in Washington, where he will testify in Congress. Traders will be watching the testimony closely as they gauge the next action from the Federal Reserve. The market will also receive CPI data from Europe and the US before his testimony. In the US, the market expects the headline CPI to remain unchanged at 1.7% on an annual basis. They expect it to increase from 0.1% to 0.3% on a MoM basis. The market expects the core CPI to increase slightly from 0.1% to 0.2%. In the UK, the market expects headline CPI to decline from 1.7% to 1.6% while in Germany, it is expected to remain unchanged.

The EUR/USD pair was unchanged in the Asian session. The pair is trading at 1.1012, which is lower than last week’s high of 1.1175. On the hourly chart, the price is along the 28-day and 14-day moving averages. The RSI has been unchanged at 45 while the average true range has been declining. The pair may see some significant movements on today’s data and Powell speech.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 22553