Reliable & regulated

Licensed across multiple jurisdictions, ensuring transparency and security.

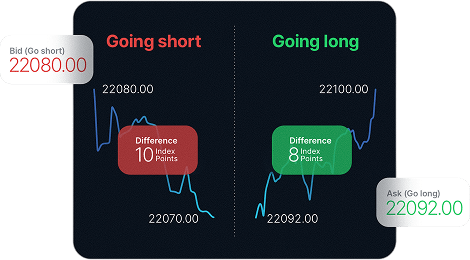

Cost-effective trading

Spreads as low as 0.0 pips, fast execution, and transparency.

Market expertise

Trade smarter with in-depth, real-time analysis from our Research Team.

Multilingual support

A dedicated multilingual Customer Support team available in your preferred language.

Intuitive platforms

Trade with confidence on industry-leading platforms available across all devices.

Portfolio diversity

10,000+ CFDs across Forex, Shares, Indices, Commodities, Bonds, ETFs, and Digital Currencies.