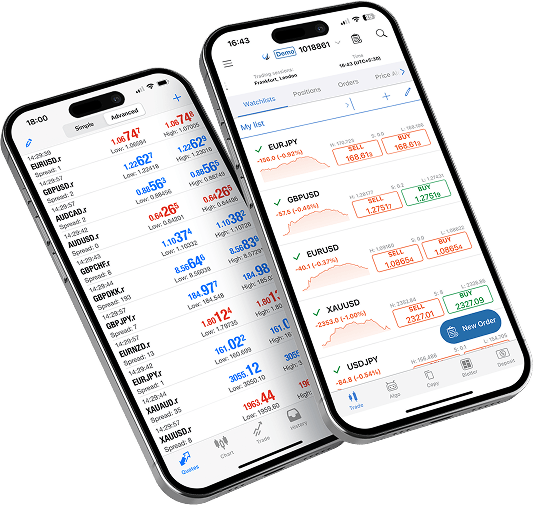

cTrader is a truly multi-asset platform, offering traders access to more than 70 forex currency pairs, including major, minor and exotics, as well as individual equity CFDs across major global exchanges. For those who prefer trading on the price movements of global indices, like the US S&P 500 and the UK’s FTSE 100, cTrader provides access to several such popular equity indexes.

Traders can also access Commodity CFDs on cTrader, including hard commodities such as crude oil, soft commodities like wheat, as well as precious metals, such as gold, silver and palladium. Exchange-Traded Funds (ETFs), Bonds, and Digital Currencies can also be accessed via the platform.

cTrader

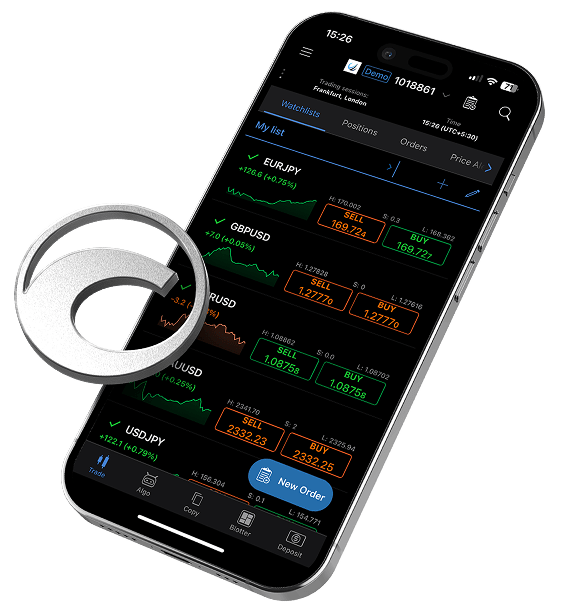

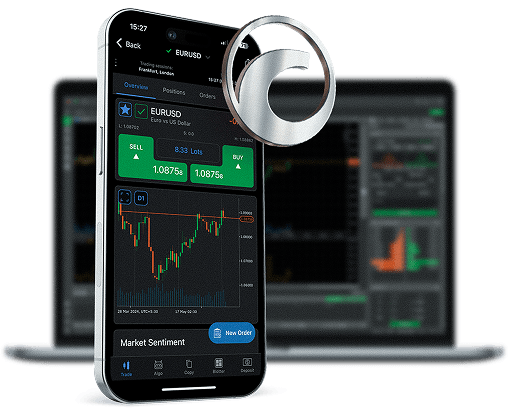

Experience powerful charting tools, advanced order types, Level II pricing, and superior execution – all from one intuitive platform.