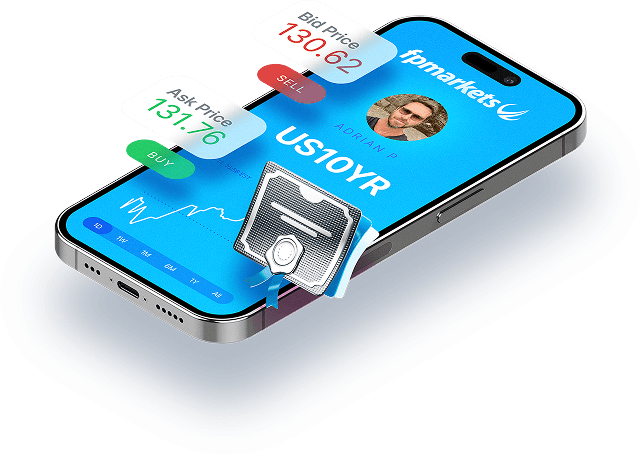

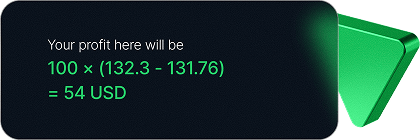

Os investidores compram títulos públicos ou corporativos como parte de sua estratégia de diversificação. Os traders podem fazer o mesmo com CFDs de títulos, pois esses derivativos acompanham os movimentos de preço do ativo subjacente.

Negociar CFDs sobre títulos oferece aos traders exposição aos mercados globais de renda fixa sem a necessidade de possuir títulos. Eles podem especular sobre as flutuações de preços em ambas as direções e encontrar oportunidades de negociação de curto prazo. Os CFDs sobre títulos também são usados para proteger contra oscilações das taxas de juros, graças à sua relação inversa.

Como acontece com todos os CFDs, a alta alavancagem e a baixa margem ajudam os traders a construir seus portfólios com menos capital quando comparado ao investimento em títulos reais.