What is CFD trading?

Discover how CFD trading works, what drives the markets, and how to trade CFD products with industry leading trading conditions.

Discover how CFD trading works, what drives the markets, and how to trade CFD products with industry leading trading conditions.

A Contract for Difference (CFD) is a type of derivative product that allows traders to speculate on the price movements of various financial instruments, such as stocks, indices, commodities, currencies, and cryptocurrencies, without owning the underlying asset. CFDs allow traders to gain profit from both rising and falling asset prices, while applied leverage may amplify gains or losses. Lastly, they enable the trader to take a position without having to take ownership of the underlying asset. This makes CFDs a good option for traders who want to gain a larger market exposure for a fraction of the full value, while being able to enter and exit trades quickly

Unlike shares, trading CFDs does not give traders any ownership rights. Traders practically agree with a broker to exchange the difference in the underlying asset’s price from the time the contract is opened to when it is closed. The closing date or contract expiry date is not fixed, making CFDs different from other forms of derivatives, like futures.

One advantage of trading CFDs is that you can speculate on price movements in any direction, up or down. The gain or loss that you make will depend on whether your forecast pans out. As CFDs are leveraged financial products, traders should use risk management tools to minimise fund losses if markets move against their forecasts.

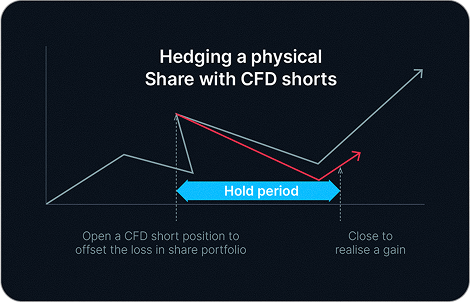

A significant advantage of CFD trading is the opportunities to hedge your portfolio against short-term market volatility, within an existing position. Hedging is a strategy you can use when you want to invest to protect against downside risks. You can also limit your gains to do this.

Let’s say you have an equity portfolio worth A$150,000, consisting of prominent shares on the ASX 200 index. These are split up in 10 tranches of A$15,000 each. You could own A$15,000 worth of Adelaide Brighton shares and A$15,000 worth of ANZ Banking Group Ltd.

Now, if you believe that both these companies might suffer a short-term dip in share price, due to a bad earnings report, you could offset some of the potential loss by going short on them through a CFD.

Instead of selling these shares in the open market, you assume two CFD short positions in Adelaide Brighton and ANZ Banking Group Ltd. About 10% of the market exposure, which is A$3,000, could be required to set up this hedge.

But, why choose a CFD short rather than simply selling the shares and buying them again later, after the price drops? The reason to choose the CFD route could be:

You will attract capital gains when you sell your shares, which is taxable. This would be unnecessary, unless you wanted to get rid of these assets once and for all. In CFDs, you won’t need to pay stamp duty and trading costs will be limited to margin and spread.

If the market does go downwards, the losses in your equity portfolio will be offset by your short CFD positions.

Holding a CFD position open overnight may incur a holding cost. Holding cost is charged after market close each day and applies to both long and short positions.

Holding costs can be positive or negative (receive or pay interest respectively), depending on the trade’s direction and the underlying asset.

CFD trading allows you to access the largest financial markets in the world. FP Markets offers thousands of tradable instruments across Forex, Shares, Indices, Metals, Commodities and Cryptocurrencies. Among them are the EUR/USD and GBP/USD currency pairs, Gold, Silver, and shares such as Apple, Amazon, Tesla etc.

One of the unique features of CFD trading is that they provide you with the ability to go 'long' or 'short'. This means that traders can benefit even from declining price movements, thus having potential for additional trading opportunities when compared to traditional financial markets.

As you do not own the underlying asset, there is no stamp duty associated with CFD trading. In addition, through the use of leverage, traders are able to make effective use of their capital by gaining greater exposure using margin trading.

Offers a cost-efficient way to invest as you only have to deposit a fraction of the trade's full value (margin) to open a position. The margin required varies depending on the instrument, liquidity and other factors.

A significant advantage of CFD trading is its use as a hedging tool. It can be utilised to hedge your portfolio against short-term market volatility within an existing position. Hedging is a strategy that CFD traders use rather than selling holdings in other instruments that may have associated tax implications.

CFDs are designed to closely track the price movements of their underlying assets. CFDs let traders gain exposure to the price performance of the asset without taking ownership or having shareholder rights.

CFDs do not have an expiry date unlike other derivatives such as options and futures. However, position holding costs should be taken into consideration when building a strategy.

There are three things to consider when it comes to CFD trading - 'Bid', 'Ask' and 'Spread'. 'Bid' (sell) is the sell price which is generally displayed on the left while the 'Ask' (buy) price is the higher of the two and the rate at which you buy the asset. The difference between these two prices is the 'spread' which reflects the cost of trading. Depending on the liquidity of your asset, the spread can be tight or wide.

CFD trading comes with costs which traders should know before building their strategies. Trading costs vary depending on the type of account you open and the platform you are using (MetaTrader 4 / 5 or cTrader). There may also be holding costs for any CFD position that is held open in your account overnight. This depends on the applicable holding rate, as well as the direction of your position; based on which the cost can be negative or positive.

Yes, FP Markets offers a Demo Account option for traders who would like to test trading waters using virtual funds. The Demo Account lets you get a taste of how you could navigate markets in realistic conditions without worrying about fund losses. Once you are ready to take the next step, open a Live Account and explore our Deposit Options.

Yes, it is possible to trade CFDs (Contracts for Difference) without leverage. Most brokerage firms offer adjustable leverage ratios, while some brokers allow investors to trade CFDs with no leverage. CFD trading without leverage would require investing more capital for fewer risks and less potential returns compared to leveraged trading. In contrast, leveraged CFDs trading would minimise the capital requirement in exchange for more risks and magnified profits or losses.

Futures are agreements to buy/sell an asset on a specific date, traded on exchanges. CFDs are contracts between a trader and a broker with no set expiration date, allowing traders to speculate on an asset’s price movement. The difference between the opening and closing price determines the profit or loss. CFDs are over-the-counter (OTC) products that retail traders use for short-term speculation.

By registering, you agree to FP Markets’ Privacy Policy and consent to receiving marketing materials from FP Markets in the future. You can unsubscribe at any time.

Quick Start & Resources

Markets

Tools & Platforms

Trading Info

About Us

Regulation & Licence